CORN

Prices were $.02-$.06 lower led by old crop. Outside day down for spot July while holding support above the May low at $4.36 ½. Support for Dec-25 is at $4.34 ½. US weather remains favorable for row crop production however heavy rains could pose a threat to the winter wheat crop just ahead of harvest. Growing supply pressure from SA will continue to shift global demand away from the US. AgRural est. Brazil’s 2nd crop harvest is just over 1% complete while raising their production forecast .7 mmt to 128.5 mmt, just below the USDA est. of 130 mmt, however well below Safras & Mercado at 139 mmt. Export inspections rebounded to 62 mil. bu., above expectations and well above the 46 mil. bu. needed to reach the USDA forecast of 2.60 bil. bu. YTD inspections at 1.913 bil. are up 29% from YA vs. the USDA forecast of up 13%.

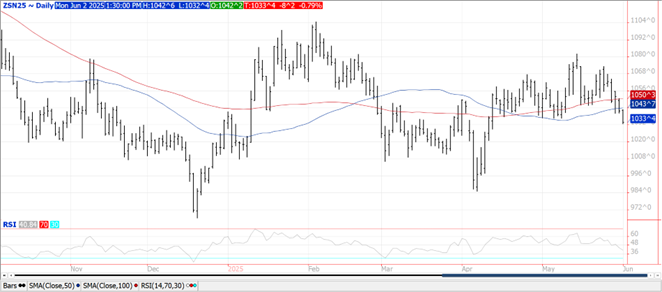

SOYBEANS

Prices were lower across the soybean complex with beans down $.08-$.10 with new crop the downside leader. Meal was off $2-$3 per ton while oil backed up 60-70 points. Bean and oil spreads firmed while meal spreads were little changed. July-25 beans slipped to an 8 week low with the next major support not until the April low of $9.85. July-25 meal remains stuck between $290-$300 ton. Fresh 7 week low for July-25 oil while closing below the 100 day MA. Spot board crush margins slipped $.04 to $1.22, a 2 month low ahead of this afternoon’s census crush data. Bean oil PV also fell to a 2 month low at 44.1%. Weekend warmth across the west will slide east bringing above to MA normal temps for the central and ECB for a couple of days before rains bring widespread cooling by mid to late week. Rains over the next week of 1-3” will be common across much of the nation’s midsection. Export inspections rebounded to 10 mil. bu., in line with expectations however below the 14 mil. needed to reach the USDA forecast of 1.850 bil. bu. YTD inspections at 1.639 bil. are up 11% from YA vs. USDA forecast of up 9%. China actually took 2.4 mil. bu. which should clean out their outstanding sales.

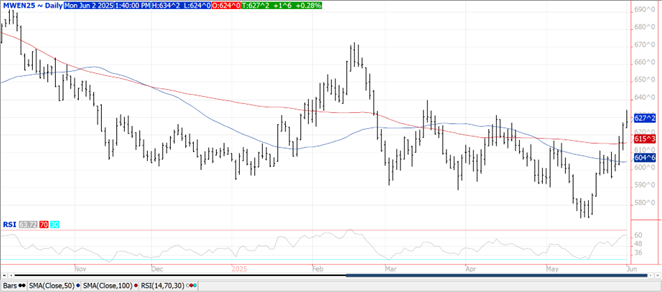

WHEAT

Prices ranged from $.02 higher in MGEX to $.06 ½ better in KC with all 3 classes settling well off session highs. KC July-25 traded to a 5 week high while stalling just below its 50 day MA at $5.51. MGEX July-25 traded to a 2 ½ month high before stalling. Heavy rains of possibly 4+” likely for the SE US plains. A dry outlook for areas of Europe including S. Russia and the Black Sea region. Key wheat areas in China’s Northern plains and the Yellow River Basis will remain dry this week, however better prospects for rain in week 2 of the outlook. Export inspections at 20 mil. bu. were in line with expectations. Inspections to date at 802 mil. are up 16% from YA, in line with the USDA forecast with only days left in the 24/25 MY. Census exports from April due out on Thursday. Australia’s Ag. Ministry is forecasting 2025 production at 30.6 mmt, down 10% from YA and just below the USDA est. of 31 mmt. IKAR reports Russia’s export price at $225/mt unchanged from the previous week. They went on the est. June exports will drop to 1.2 mmt, down from 2.1 mmt in May-25. Their Ag. Ministry slashed their export tax 25% to $1,023 roubles/mt for a period ending June 10th. MM’s were net buyers of another 12k contracts across the 3 classes of wheat reducing their combined short position to 211k, vs. the recent record at 235k contracts.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.