Soybeans, soymeal and corn futures jumped higher. Wheat traded higher. Soyoil traded lower. So much for negative USDA report. Bullish USDA FSA enrollment acres and a 2 week US Midwest drier than normal forecast triggered massive fund buying and equal massive farmer selling.

SOYBEANS

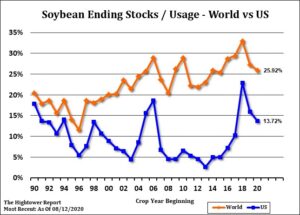

Soybean trade higher. Funds were massive buyers after a bullish USDA 2020 crop insurance enrollment acre number. Fact China continues to be a big buyer of US new crop soybeans also offered support and offset yesterday bearish USDA estimate of US 2020 crop and 2020/21 carryout. USDA FSA enrollment soybean acres were near 75.9 million or 6 million below the number that would confirm USDA 83.8 million planted acres. There was also 1.2 million prevent plant soybean acres. Most of these acres were in ND. Trade is buying these bullish numbers. FSA did say they were missing data due to delay enrollments. Weekly US old crop soybean sales were 570 mt. Total commit is near 47.5 mmt versus 48.5 last year. China has shipped 14.1 mmt with total commit near 16.8. USDA goal is 44.9 versus 47.6 last year. New crop sales were near 2.8 mmt. Total unshipped open sales are near 17.9 mmt of which China is 10.2.Unknown is 5.2 mmt. Some expect China to take 25 mmt US 2020/21 soybeans.

CORN

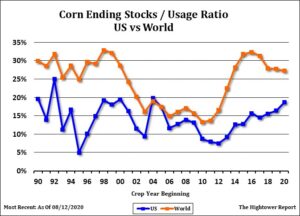

Corn futures jumped on a bullish reaction to USDA FSA crop insurance acreage enrollment report. USDA FSA enrollment corn acres were near 81.1 million or 7 million below the number that would confirm USDA 92.0 million planted acres. There was also 5.4 million prevent plant corn acres. Managed funds were net buyers of 38,000 corn contracts on huge volume. FSA did say they were missing data due to delay enrollments. US farmer was equally big seller of old and new crop cash corn. Most feel that the FSA numbers should go higher. Best month for the report is October. Some though are looking for 200-300 mil bu less final production due to recent heavy wind storm that went through Iowa. Drier than normal US Midwest 2 week weather forecast could also take the top off the US final corn yield. Some look for USDA weekly corn crop rating to drop 4-5 pct on Monday. Weekly US old crop corn sales were only 377 mt. Total commit is near 44.1 mmt versus 50.0 last year. USDA goal is 45.6 versus 52.4 last year. New crop sales were near 553 mt. Total unshipped open sales are near 11.4 mmt of which China is 5.7. CZ hit buy stops near 3.18. Todays high is near the next level of resistance near 3.29. Most do not recommend end users to chase this rally and suggest farmers should increase cash sales.

WHEAT

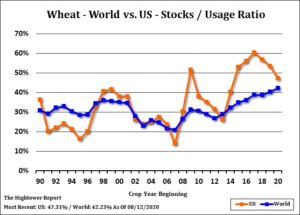

Wheat futures traded higher following the big gains in corn, soybean and soymeal. Corn and soybean rallied on lower than expected USDA FSA enrollment acres. That same report suggested US wheat planted acres are close to what farmer said they planted. WU found support near 4.90. WU is back near 5.00 with resistance near 5.10. KWU also found support near a double bottom near 4.10. KWU is back near 4.25 with next resistance near 4.32. WU-KWU spread has now backed off recent highs near 90 cents and is now near 71 cents. Next support is near 63 cents. KC has found new support after USDA dropped the 2020 crop estimate and end stocks forecast. USDA raised HRS stocks 23 mil bu and dropped HRW 23. USDA failed to increase 2020 Australia and Canada crop numbers. They raised Russia 1.5 and lowered EU 4.0. Some feel final World crop will be larger. Weekly US wheat export sales were only 367 mt. Total commit is near 10.5 mmt versus 9.8 last year. USDA goal is 26.5 versus 26.2 last year. USDA est World wheat trade near 187 mmt versus 189 last year. Russia is 37.5, EU 25.5, Canada 24.5, Ukraine 18.0, Australia 17.5 and Argentina 14.0.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.