Soybeans, soyoil, soymeal and corn futures traded lower. Wheat traded higher. US Dollar was lower. Crude was lower. Gold was lower. US Fed comments that Covid could pose a risk to US economic outlook weighed on commodity prices.

SOYBEANS

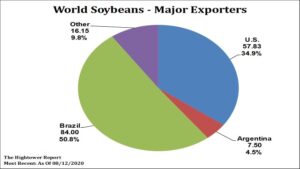

Soybean prices traded lower. Some link this to an improved US weather forecast and talk of higher US 2020 supply. Nov futures are back testing 9.00. USDA estimates that is 2020 World soybean crop will increase 33 mmt. US is up 22 mmt, Brazil 8 mmt and Argentina 4 mmt. There are also some that feel their demand outlook could also be high especially their estimate of US soybean exports. There is also talk that fact that Brazil farmers are getting record local currency for their soybean they could increase 2021 acres by 4 pct. Weather maps hint that late next week 65 pct of the Midwest could see .75-2.50 inches of rain. China announced that will begin US trade talks soon. Their appetite for energy, soybeans, wheat and corn suggest Covid is behind them and their economy is growing. Weekly US soybean old crop export sales were -.5 mil bu. Total commit is near 1,745 mil bu versus 1,786 last year. USDA goal is 1,650 versus 1,752 last year. New crop sales were 94 mil bu with total sales near 755 mil bu. USDA estimates US 2020/21 export near 2,125. Some feel that may be high.

CORN

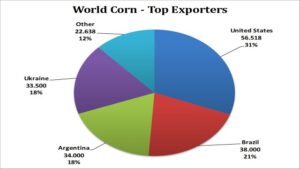

Corn futures traded lower but off session lows. Early weakness was linked to feelings that US corn yield may not drop as much as feared. Forecast of needed rains across the US Midwest late next week also offered resistance. Rumors of China interest in US corn may have offered support into the close. Pro Farmer tour participant estimated IL 2020 corn yield near 189.4 versus their estimate last year of 171.1 and USDA August guess of 207.0. Pro Farmer tour participant estimated W IA 2020 corn yield near from 172.4 to 184.7 versus their estimate last year of 184.9 to 192.7 and USDA August guess of 202.0. Participants reported that the crops need a good rain to achieve these yields. Today, the tour will travel through the rest of IA and MN. The tour ends today and will report a US 2020 corn yield tonight at 8.00. Pro Farmer will release a corn yield tomorrow at 1:30 based on moisture conditions, crop maturity and will include estimate that also includes states outside the main US corn belt. Weekly US corn old crop export sales were 2 mil bu. Total commit is near 1,741 mil bu versus 1,972 last year. USDA goal is 1,795 versus 2,066 last year. New crop sales were 28 mil bu with total sales near 480 mil bu. USDA estimates US 2020/21 export near 2,225. Some feel that may be high. USDA estimates World 2020 corn production to increase 60 mmt with US up 43 and Brazil up 8 mmt. Some feel next weeks US corn crop rating will drop another 1-2 pct.

WHEAT

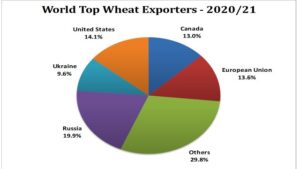

Wheat futures traded higher. WZ has found support again near 5.00. Open interest is going up but trade volume is low. WZ moved above the 20,50 and 100 day moving average over the last few days. Fact China is buying US wheat and more rumors today of new buying helped futures. There is talk that China is in the marker buying futures on the close over the last few days. There are signs that China Covid is behind them and their economy may be improving. Besides wheat, China is buying energy, soybeans and corn. China reports both hog and poultry number are increasing. China has been selling corn, wheat and rice from reserves for feed. Weekly US wheat old crop export sales were 19 mil bu. Total commit is near 408 mil bu versus 383 last year. USDA goal is 975 versus 965 last year. USDA estimates World 2020 wheat production to drop 2 mmt. Lower EU crop cannot be totally offset by higher Canada, China, India, Australia and Russia. Some feel USDA could increase the crop size in coming reports.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.