Soybeans traded lower. Corn and wheat traded higher. Interesting news day. ASF found in Germany pushed hog futures sharply higher. China, S Korea and Japan said they would not import pork from Germany. Key USDA report tomorrow. China talking about adding to strategic reserves from 2021-2025. US stocks traded lower. US Dollar was lower. Crude was lower.

SOYBEANS

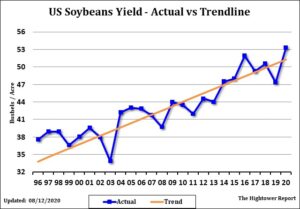

Soybeans traded lower led by SX21.USDA report and their estimate of US 2020 soybean yield and 2020/21 carryout will be key to future price direction. Managed funds are net long 190,000 soybean contracts. This is close to a record long going into US harvest. They only time since 2006 funds have been this long now futures traded lower from here into November. Also on Friday USDA will issue a new US/World soybean supply and demand report. September report will include average pod count and seed size/weight along with a new farmer survey. Average soybean crop trade guess is 4,292 mil bu versus USDA Aug guess of 4,425. Trade is looking for a US 2020/21 carryout of 469 versus USDA Aug 610.Soybean futures have rallied with funds adding to their net long after the USDA August report with China a steady buyer of US soybeans and while weekly crop ratings have declined. Weekly US soybean export sales are estimated near 1,100-1,900 mt versus 1,762 last week.

CORN

Corn futures traded higher. Managed funds added to their net long futures position in front of USDA crop report and US harvest. China has announced it plans to boost its strategic commodities reserves to assuage anxiety over energy and food security. Starting in 2021, it will make what Bloomberg calls “mammoth” purchases of crude, strategic materials, and farm goods, officials apparently say. This is being done to ensure China can ride out any repeat of this year’s supply disruptions, or a deterioration in trade relations with the US, for example. This is apparently part of the shift to “internal circulation”, or greater self reliance, which is already being flagged, and which will kick in for the five year plan 2021-25. There is talk that China could import 30 mmt of all origins corn in 2021 and 2022. On Friday, USDA will issue their monthly US/World supply and demand report. Average corn crop trade guess is 14,891 mil bu versus USDA Aug guess of 15,278. Trade is looking for a US 2020/21 carryout of 2,461 versus USDA Aug 2,756. Weekly US corn export sales are estimated near 1,000-1,900 mt versus 2,389 last week. Weekly US ethanol production was up 2 pct from last week and down 8 pct from last year. Stocks were down 4 pct from last week and down 11 pct from last year.

WHEAT

Wheat futures traded higher in front of USDA monthly supply and demand report. Most do not expected USDA to make many changes to the Wheat numbers. If anything they could increase production in Australia, Russia and Canada. Parts of Europe and the Black Sea are dry. This could slow the start of the 2021 winter wheat planting season. Rains have finally fallen across parts of the US HRW growing areas. This should helping planting conditions there. This week Russia fob export prices have rallied. Over the last 30 days prices are up $23. This has helped support US futures. Russia prices are up due to the lack of farmer selling. On Friday USDA will issue a new US/World wheat supply and demand report. Trade is looking for a US 2020/21 carryout of 926 versus USDA Aug guess of 925. Trade is also looking for World end stocks near 315.8 mmt versus 316.7 in August. Despite the rally in Russia prices their prices are still lower than US. Weekly US export sales are estimated near 250-600 mt versus 585 last week.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.