Soybeans and soymeal traded higher led by the nearby. Soyoil and wheat traded lower. Corn traded lower led by the nearby. US stocks were sharply lower. Some link this to profit taking in key tech stocks. US Dollar was lower. Crude was lower. Gold lower. Good weekly export sales helped hog futures rally.

SOYBEANS

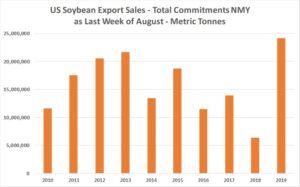

Soybean traded higher. Continued China buying US soybeans offered support. Record large Q4 US soybean export liftings offered support to nearby futures. Talk China is now starting to buy Brazil Feb forward may have weighed on 2021 contracts. Brazil is also looking at record 2021 crop. Most look for a 1 pct from in next week’s US soybean crop ratings. Another crop analyst estimated US 2020 soybean crop near 4,368 mil bu and a yield near 52.5. This group has a US 2020/21 soybean carryout near 610 mil bu. Food and Ag Commodity Economics (Informa) will be out Friday with their estimate. They have been using a soybean crop near 4,236 mil bu, yield near 51.0 and US 2020/21 soybean carryout near 463 versus USDA 610. Soybean futures have not traded higher for 10 straight day. Weekly US soybean export sales were near 1.7 mmt. Unshipped open sales are near 24.1 mmt. China sales were near 1.01 mt. 2019/20 export commit is near 47.5 mmt versus 48.7 last year. USDA estimates US 2020/21 exports near 57.8 mmt. USDA announced 318 mt US soybean were sold to unknown and 132 mt US soybean were sold to China.

CORN

Corn futures traded lower led by the nearby contracts. Approaching US harvest may have weighed on prices. US farmer though remains a reluctant seller of cash. This is helping the domestic basis. Early next week. IA and Il are forecasted to finally get some rain, Still most look for weekly US corn crop ratings to drop another 1 pct. Another crop analyst estimated US 2020 corn crop at 15,005 and a yield near 179.5. This group has a US 2020/21 corn carryout near 2,895 mil bu. Food and Ag Commodity Economics (Informa) will be out Friday with their estimate. They have been using a corn crop near 14,828 mil bu, yield near 176.5 and US 2020/21 corn carryout near 2,496 versus USDA 2,756. Weekly US corn export sales were near 2.4 mmt. Unshipped open sales are near 15.8 mmt. China sales were near 1.155 mt. 2019/20 export commit is near 44.5 mmt versus 49.9 last year. USDA estimates US 2020/21 exports near 56.5 mmt. China sold only 34 pct of their corn auction. Some feel approaching 2020 corn harvest could finally increase supplies and bring down record domestic prices. This could also slow new export sales. Most look for China to imports a record 20 mmt corn, 12 from US and 4 each from Brazil and Ukraine.

WHEAT

Wheat futures traded lower. On again off again wheat trade was off again today. Some link this to slow World export traded versus adequate supplies. Australia and Baltic wheat is beginning to reduce Russia export demand. Large World supplies could also reduce US export demand. Weekly US wheat export sales were near 585 mt. 2020/21 export commit is near 12.4 mmt versus 11.4 last year. USDA estimates US 2020/21 exports near 26.5 mmt versus 26.3 last year. Egypt bought only 55 mt in their tender. They had to pay the highest prices so far this market year for their wheat. USDA continues to estimate World wheat trade near 188 mmt versus 189 last year. Combined Russia and Ukraine is 56.0 mmt versus 52.0 last year. Canada 24.5 versus 23.9 last year. EU 25.5 versus 38.0 last year. Australia 17.5 versus 9.5 last year. SE Asia buys 26.3 mmt versus 26.4 last year. N Africa buys 29.6 versus 28.0 last year. Mideast buys 18.0 versus 17.8 last year.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.