Soybeans, soymeal and wheat traded higher. Corn and soyoil traded lower. US stocks were higher. US Dollar was lower. Crude was higher.

SOYBEANS

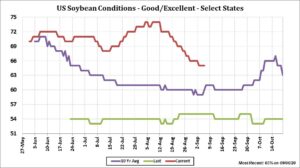

Most markets turned around from recent trends. Soybean were supported by another day of US soybean sold to China and unknown. Managed funds added to their net long. Their net position is near all time highs in June, 2016 and Feb, 2018. Some report a few fund managers lightened their net soybean long today and in front of Fridays USDA report. Some feel USDA estimate of China 2020/21 soybean imports near 99.0 mmt may be 1-2 mmt too low. POTUS administration could announce this week that EPA could deny retroactive biofuel waiver request. RIN values are higher on the news. China announced CPI up 2.4 pct. Pork prices are up 52 pct due to drop in supplies due to ASF. Does this suggest post Covid could trigger inflation? USDA estimated US soybean crop 65 pct good/ex. Best crop are in AR, KY, TN, IL, IN, MO, MN and WI. Lowest rated crops are in IA, MS and OH. One group estimates US soybean yield near 51 versus average trade guess of 51.7 and USDA August guess of 53.3.

CORN

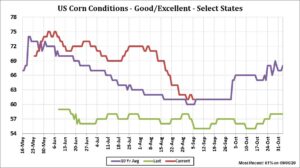

Corn futures traded lower. There was talk that US farmer selling has increased once CZ tested 3.60. Farmers have been reluctant sellers due to uncertainty of yield potential and concern selling now would reduce their chances for future Covid aid payments. USDA estimated US corn crop 61 pct good/ex. Best crops are in KY, MO, MN, IL, IN, SD and WI. Lowest rated crop are in IA and OH. One group estimates US corn yield near 176 versus average trade guess of 178.4 and USDA August guess of 181.8. USDA report is Friday. Some look for USDA to drop 2019/20 corn ethanol use and exports. Still drop in US crop size could lower US 2020/21 carryout. Most look for a slight increase in weekly US ethanol production from last week and a modest increase in stocks. POTUS administration could announce this week that EPA could deny retroactive biofuel waiver request. China announced CPI up 2.4 pct. Pork prices are up 52 pct due to drop in supplies due to ASF. Does this suggest post Covid could trigger inflation? U of IL estimated that current profit per ace for corn planted in 2021 is near $110 dollar per acre. Soybean following wheat is expected to profit $179 per acre. This could increase Midwest 2021 winter wheat acres versus corn. This could provide long term support to CZ21 futures prices.

WHEAT

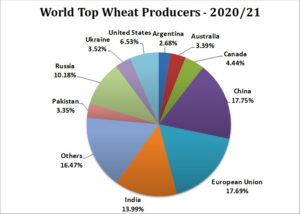

Wheat futures managed small gains. Choppy trade in wheat linked in part to volatility in US Dollar and financial markets. There is also concern that Covid could continue to reduce demand for wheat. Most do not look for USDA to make many changes to US or World Supply and demand numbers on Friday. Wheat futures are near season highs. Some link that to slow Europe and Black Sea farmer selling and continues dryness across parts of Europe, Black Sea and Argentina. The extended 16-30 day weather models suggest some rains for parts of Europe and Black Sea. Ukraine Ag Minister suggested farmers not plant winter seeded crops until they get some rain. USDA estimated that 82 percent of the US spring wheat crop was harvested. 5 percent of the US 2021winter wheat crop was planted. Average trade guess for US 2020/21 wheat carryout is 926 mil bu versus USDA 925. Average trade guess for World 2020/21 wheat carryout is 316.1 mmt versus USDA 316.8.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.