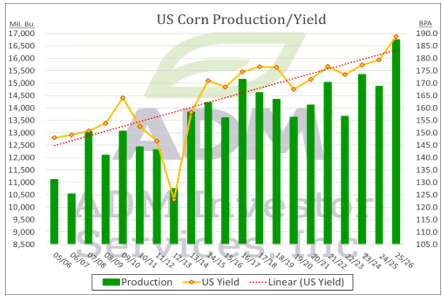

CORN

The USDA lowered old crop 24/25 ending stocks 35 mil. to 1.305 bil. slightly below expectations. Exports for 24/25 were raised another 70 mil. bu. to 2.820 bil. Usage for ethanol production was cut 30 mil. bu. with other FSI usage down 5 mil. The 2025 harvested acres were revised up nearly 2 mil. to 88.69 mil. while the Ave. US yield rose 7.8 bpa to record 188.8 bpa. Production up nearly 1 bil. bu. to record 16.742 bil. roughly 750 mil. above expectations. The increase in production and yield was the largest ever in the August report. The previous biggest change came in 2016 when production rose 613 mil. bu. with the Ave. yield rising 7.1 bpa. New crop 25/26 demand rose 545 mil. bu. to nearly 16 bil. US ending stocks rose to 2.117 bil. bu. which if verified would be a 7 year high and 215 mil. above expectations. Stocks/use at 13.3% is a 6 year high. These optimistic usage figures will have to prove themselves over the course of the MY. The Ave. US farm price for 2025/26 was cut $.30 a bu. to $3.90. Global stocks were up 10.5 mmt to 282.5 mmt due only to the higher US inventories, otherwise minimal change in the global S/D’s. Surprised to see Brazil’s 24/25 production left unchanged at 132 mmt. Chinese 24/25 stocks down 1 mmt on lower imports. Next support for spot Sept-25 is $3.60 ½, the low from last August on the weekly chart.

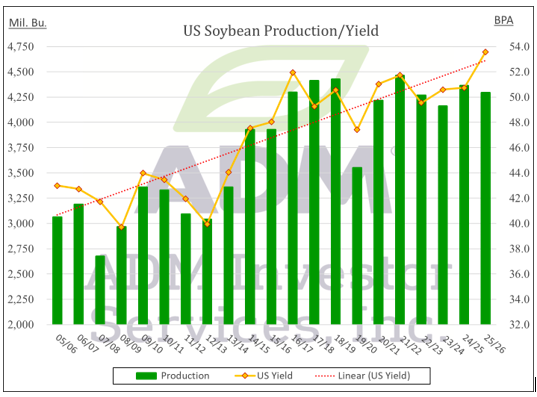

SOYBEANS

Prices were higher across the complex with beans up $.20-$.22, meal and oil were both only slightly higher. Nov-25 beans traded thru both its 50 and 100 day MA resistance. Next resistance is the mid-July high at $10.43 ¼. Spot board crush margins were pummeled today falling $.19 to $1.92 bu. Bean oil PV held steady at 48.6%. Old crop 24/25 ending stocks were down 20 mil. to 330 mil. slightly below expectations, on a 10 mil. bu. increase in both exports and crush. To absorb the higher supplies from higher crush rates, bean oil domestic usage rose 150 mil. lbs. while exports rose 50 mil. keeping stocks steady at just over 1.5 bil. lbs. Meal exports rose 1%. 2025 soybean harvested acres were down 2.4 mil. from July to 80.1 mil. The Ave. yield rose 1.1 bpa to a record 53.6 bpa. Production was down 43 mil. bu. to 4.292 bil. roughly 75 mil. below expectations. New crop 25/26 exports were cut 40 mil. bu. US ending stocks are projected to fall to 290 mil. bu., just below the range of estimates, while stocks/use is forecast to drop to 6.7%, the lowest in 3 years for both. The Ave. US farm price for 2025/26 held steady at $10.10 bu. Global stocks were down 1 mmt to 125 mmt at the low end of expectations. After yesterday’s close Pres. Trump extended the trade truce with China for another 90 days allowing more time to negotiate a trade deal. As it stands until a US/China trade deal is complete, China will only buy enough US beans to fill in where needed ahead of Brazil’s next harvest early next year. That window continues to shorten.

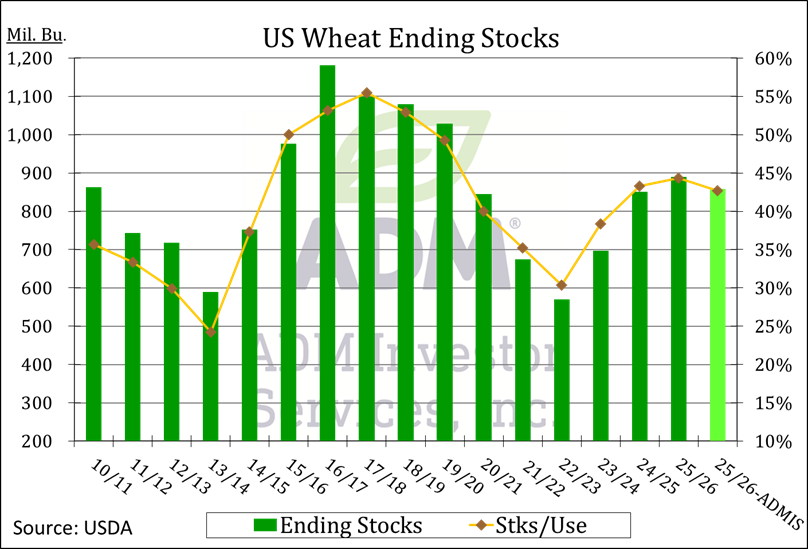

WHEAT

Prices ranged from slightly lower in MIAX futures to $.10 lower in CGO. New contract low for Sept-25 CGO however managed to hold above the $5.00 level. All US wheat production fell 2 mil. to 1.927 bil. bu. slightly above expectations. The Ave. yield at 52.7 bpa matches the record high from 2016. Winter wheat production increased 10 mil. to 1.355 bil. roughly 10 mil. above expectations. HRW production was up 14 mil. to 769 mil., SRW up 2 mil. to 339 mil. while white was down 7 mil. Spring wheat production was down 20 mil. to 484 mil. while durum was up 7 mil. to 87 mil. bu. Demand rose 20 mil. with exports up 25 mil. and food usage down 5 mil. The increased exports was all for the HRW futures (KC) more than offsetting the higher production enabling stocks to slip 15 mil. to 416 mil. All wheat ending stocks were cut 21 mil. to 869 mil. nearly 15 mil. below expectations however still a 6 year high. The 2025/26 Ave. farm price fell $.10 to $5.30 bu. World stocks were down 1.5 mmt to 260 mmt, at the low end of expectations. Chinese wheat production fell 2 mmt to 140 mmt which was offset by a 2 mmt reduction in their domestic feed usage.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.