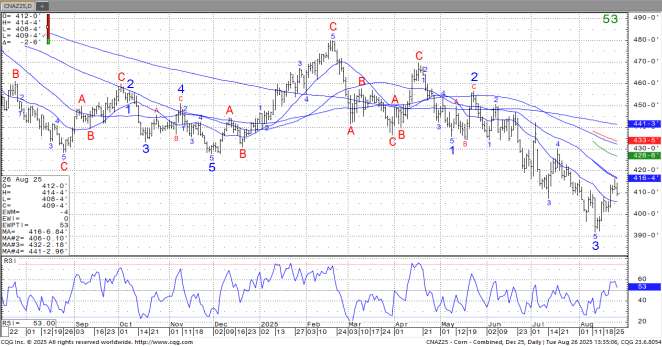

CORN

CZ is near 4.09. One estimate of lower US 2025 corn yield and good US exports have supported CZ. CZ is unable to trade over 4.16 resistance. Support is 4.05. US Midwest weather is mostly dry but cool. Harvest is into KY where corn yields are reported at record high. USDA rated the US crop 71 pct G/E unch from last week but up vs 65 ly. One analyst est US corn yield near 187.1. Another remains near 184.0 but concedes that final yield could be between 184.0 and 188.0. Same analyst is est Brazil corn crop at 140 mmt. CU open interest is down 38,000 contract but open interest remains near 128,000 which is high going into first notice. One group est US 24/25 corn carryout at 1,420 due to lower residual and 25/26 at 2,485 due to lower exports.

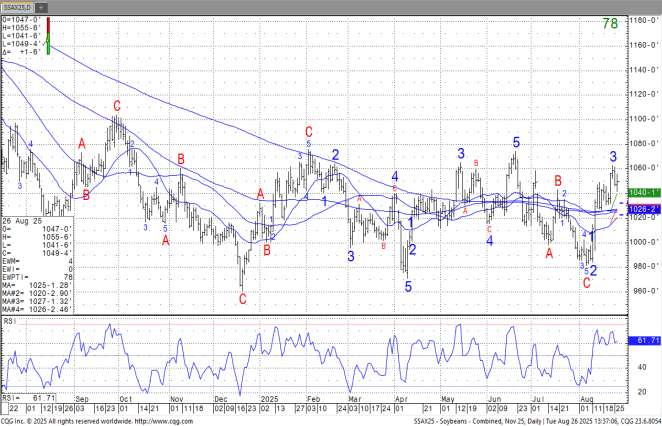

SOYBEANS

SX is near 10.49. SX has lost most of the overnight gains. Gains linked to news that a China trade representative was coming to Washington. Most is Washington said he was not meeting with key US trade officials. SX support is 10.25. Soyoil is losing to soymeal. There is concern over no reallocation of SRE’S. Some est that China will need to buy 18-19 mmt for November to January before Brazil next harvest. USDA rated US crop 69 pct G/E and some this suggest a yield closer to 54 bpa. One group est US 24/25 soybean carryout at 367 due to lower residual and 25/26 at 398 due to lower export.

WHEAT

WZ is near 5.31. KWZ is near 5.17. MWZ is near 5.92. Matif wheat futures were lower on new EU wheat crop could be near 141.0 mmt vs USDA 138.2. Also World wheat trade could be 8-10 mmt below USDA estimate, This could add to exporters end stocks. There is concern about quality of the EU and Black Sea wheat crops. Australia and Argentina futures were lower on a mostly favorable start to 2026 wheat crops. WZ remains in a 5.20-5.40 range. Some estimate the futures range could be eventually between 5.00 and 5.50. USDA estimated US spring wheat crop 49 pct G/E vs 69 last year. 53 pct of crop is harvested.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.