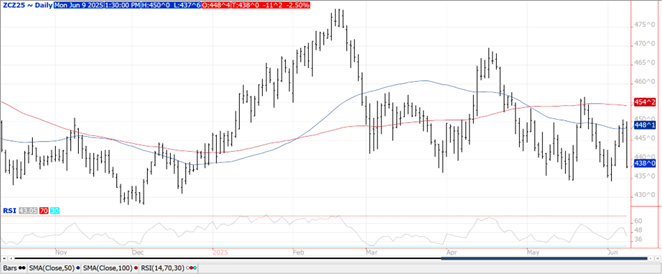

CORN

Prices ranged from $.09-$.11 lower finishing near session lows as weather premium was extracted with the non-threatening US weather forecasts.. New crop futures led the declines as spreads were under pressure. Support for Dec-25 rests at LW’s low at $4.34 ¼. Export inspections rebounded to 65 mil. bu. above expectations and well above the 40 mil. bu. needed to reach the USDA forecast of 2.60 bil. bu. YTD inspections at 1.980 bil. are up 29% from YA vs. the USDA forecast of up 13%. Largest takers were Mexico – 16 mil., Taiwan – 11 mil., Korea – 8 mil. while Japan and Colombia took 5 mil. each.

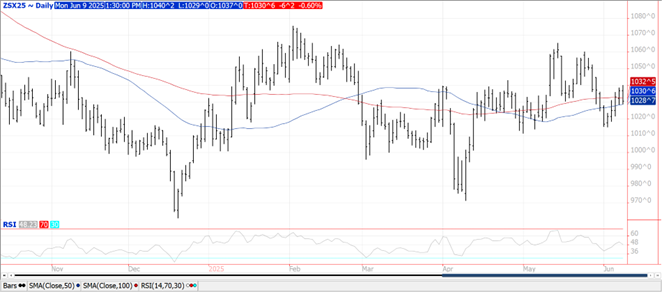

SOYBEANS

Prices turned lower across the entire soybean complex. Beans were down $.01-$.06 led by new crop. Meal was steady to nearly $2 lower while oil was down 15-20 points. Spreads finished higher across the complex. July-25 beans traded to a new monthly high overnight before pulling back. Support rests at the 100 day MA at $10.50 ½. Nov-25 soybeans consolidated near its 50 and 100 day MA’s. Meal remains range bound while July-25 oil topped out just below $.48 lb. Board crush margins were little changed. As US/China trade negotiations kick-off in London this week’s negotiations will likely focus on China’s rare earth metal exports to the US and our high end computer chips to China. Not much mention of China satisfying the Phase 1 of the trade agreement for US agricultural purchases from 2020. Trade talks will eventually evolve to cover China’s agricultural imports from the US, however these details are likely further down the road. Export inspections jumped to 20 mil. bu., above expectations and well above the 13 mil. needed to reach the USDA forecast of 1.850 bil. bu. YTD inspections at 1.660 bil. are up 11% from YA vs. USDA forecast of up 9%. Largest takers were Egypt, Indonesia, Mexico and Japan all taking 3+ mil. bu.

WHEAT

Prices ranged from down $.10-$.13 across the 3 classes today. July-25 CGO overnight rejected trade above the May high while stalling out below its 100 day MA resistance at $5.62 ¼. July-25 KC also scratched out a fresh 7 week higher overnight before pulling back. SovEcon raised their 2025 Russian wheat production forecast 1.8 mmt to 82.8 mmt, still just below the USDA est. of 83 mmt. IKAR reports Russia’s wheat export price closed LW at $225/mt, unchanged from the previous week. APK-Inform lowered their 2025 Ukraine wheat production forecast .1 mmt to 21.7 mmt, below the USDA est. of 23 mmt. Export inspections at 10.7 mil. bu. were at the low end of expectations. Roughly 4.5 mil. bu. were for the 24/25 MY which closed out at the end of May, while 6.2 mil. were for 25/26 MY.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.