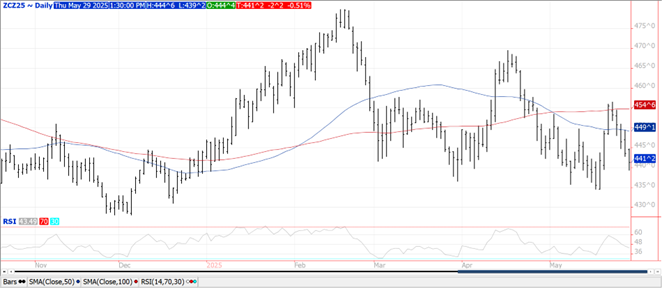

CORN

Prices were $.02-$.04 lower today with old crop leading the declines. Nearby spreads backed off another $.02 despite the USDA announcing fresh sales of 104k mt of corn to Mexico and another 101k mt to an unknown buyer. Next support for July-25 is the May low at $4.36 ½. Export demand will start its seasonal shift toward SA. Argentine FOB offers are running $8-$15 per ton below US offers for July/Aug. Recent rains should give Brazil’s 2nd crop a boost. Some estimates are as high as 140 mmt for their entire 24/25 crop, well above the USDA’s 130 mmt forecast. Ethanol production rebounded to 1,056 tbd, or 310.5 mil. gallons, up from 305 mil. the previous week however down 1% YOY. Production was within trade expectations.

SOYBEANS

Prices were mixed across the complex today. Beans were steady to $.03 higher with spot July the upside leader. Meal rebounded $2-$3 per ton while oil backed up 45-55 points in volatile trade. Bean and meal spreads were firmer, while oil spreads weakened. July-25 beans have traded below both its 50 and 100 day MA’s, however held support above this month’s low at $10.36 ½. July-25 meal has been stuck between $290-$300 a ton for 5 weeks now. July-25 oil has slipped to a 2 week low, however so far held support at its 50 day MA at 47.72. Spot board crush margins slipped $.03 to $1.32 ½ bu. with bean oil PV slipping to a 6 week low at 44.9%. Not likely to hear from the EPA on RVO mandates until June. There was limited reaction in the Ag. space to the news that the US Court of International Trade ruled Pres. Trump didn’t have the authority to impose reciprocal tariffs on a vast majority of our trading partners. While there will be legal challenges from the Trump Administration, the court ruling would seem to remove a great deal of leverage from Trump’s trade negotiators. US weather remains crop friendly. Healthy rains for the SC plains yesterday. Thru the upcoming weekend rains will favor SE Midwest. Temperatures will gradually warm to above normal readings as we flip over to June. The next round of rains are forecast to impact the N. Plains early next week, gradually spreading east across N. Midwest by the middle of next week. Longer range forecasts remain warm and wet across much of the Midwest thru the first 10 days of June.

WHEAT

Prices turned higher across all 3 classes ranging from $.03 better in CGO to $.13 higher in MGEX. Spreads continue to witness a rebound. Inside trade for both July-25 KC and CGO while MGEX surged to a 6 week high closing just above its 100 day MA. MGEX July-25 premium to CGO jumped out to a 15 month high at $.81 ½ bu. India’s Ag. Ministry raised their 2025 wheat production forecast 2.1 mmt to a record 117.5 mmt, now just above the USDA forecast of 117 mmt. Egypt maintains they have enough reserves to cover 6 months of usage. Dry conditions in Australia have shifted 2025 production est. down to just over 30 mmt, off nearly 4 mmt from previous year despite planted acres being unchanged. In the US winter wheat acres in drought slipped 5% to 16%, the lowest since July-24. Spring wheat acres in drought held steady at 29%.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.