TODAY—WEEKLY EXPORT SALES—

Overnight trade has SRW Wheat up roughly 9 cents, HRW up 9; HRS Wheat up 9, Corn is up 5 cents; Soybeans up 13; Soymeal up $3.00, and Soyoil up 65 points.

Chinese Ag futures (January) settled up 51 yuan in soybeans, up 9 in Corn, up 59 in Soymeal, up 6 in Soyoil, and up 56 in Palm Oil.

Malaysian palm oil prices were up 111 ringgit at 3,208 (basis January) near 4-year highs supported by a steep decline in October stocks and production.

U.S. Weather Forecast: The 6 to 10 day forecast has moderate rainfall in the eastern half of KS, OK, and TX with lighter amounts in the western areas of the region the first half of next week. Moderate rainfall also looks to fall in most of the Midwest with some higher rainfall totals in the central Midwest. Temps will run above average through early next week with cooling to average in the Plains by the middle of next and the Midwest by the end of next week.

South America Weather Forecast: The Brazilian growing regions still has hit and miss moderate rainfall amounts over the next 6 to 10 days with coverage up to 85%. Temps will run near average over the next 6 to 10 days. The Argentine growing regions continues with limited rainfall over the next 6 to 10 days with some rains falling in the south moving up the east coast. Temps will be running near average over the next 6 to 10 days with some above average readings developing as we head through next week.

The player sheet had funds net sellers of 2,000 contracts of SRW Wheat; bought 6,000 Corn; bought 13,000 Soybeans; bought 6,000 Soymeal, and; net bought 3,000 Soyoil.

We estimate Managed Money net long 39,000 contracts of SRW Wheat; long 231,000 Corn; net long 228,000 Soybeans; net long 86,000 lots of Soymeal, and; long 93,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 3,600 contracts; HRW Wheat down 930; Corn up 7,000; Soybeans down 4,400 contracts; Soymeal up 1,800 lots, and; Soyoil up 3,000.

Deliveries were 1 contract for Soybeans.

There were changes in registrations (Soyoil down 27; Soymeal down 30)—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 1; Soybeans 447; Soyoil 1,880 lots; Soymeal 193; Rice 282; HRW Wheat 113, and; HRS 1,195.

Tender Activity—Egypt seeks optional-origin wheat—S. Arabia seeks 600,000t optional-origin wheat—-Japan bought 91,000t U.S./Canadian/Australian wheat—Jordan passed on 120,000t optional-origin wheat—

U.S. ethanol production for the week ended October 30th averaged 961,000 barrels per day (up 2.13% versus a week ago, down 5.23% versus a year ago); stocks totaled 19.675 mil barrels (up 0.38% versus a week ago, down 10.05% versus last year); corn use for the week was 95.5 mil bu (93.5 mil last week) and versus the 97.9 mil bu needed to meet USDA projections.

US ethanol production is up 20,000 barrels per day this week, bringing the daily production figure up to 961,000 barrels per day; the uptick is counter to the expectation of grains traders that production would fall as rising coronavirus cases limit fuel consumption; meanwhile, ethanol inventories also rose, possibly a reflection of a resurgent Covid-19.

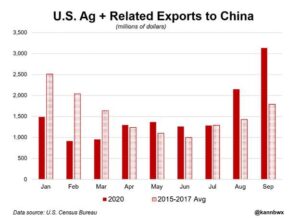

China’s strong return to the U.S. soybean market in recent months has single-handedly lifted U.S. farm exports to the Asian country to new records, and the heavy forward shipping schedule bodes well for the promises outlined in the Phase 1 trade agreement between the two countries; that agreement suggests China in 2020 will buy and import at least $36.5 billion worth of American agricultural products, an all-time high; progress was relatively dismal through mid-year, but the narrative has since changed.

Democratic U.S. Rep. Collin Peterson, House Agriculture Committee chair, failed to win re-election in Minnesota on Tuesday, a loss some agriculture leaders said could hurt the Midwest grain belt; though Democrats retained control of the House and therefore will again chair the committee, Peterson’s exit could shift U.S. spending away from a region hammered by U.S. President Donald Trump’s trade war with China.

Food prices rose for a fifth consecutive month in October, the United Nations’ Food and Agriculture Organization said; the FAO’s Food Price Index, which tracks prices of the most common food commodities, rose 3.1% in October to 100.9, its highest level since January.

China will import over $22 trillion worth of goods over the next decade, and the country is accelerating its opening up in spite of the global coronavirus pandemic, Chinese President Xi Jinping said; speaking via video message at the opening of the Nov. 5-10 China International Import Expo, or CIIE, an annual import show in Shanghai, he said the world should not let unilateralism and protectionism undermine the international order; we should take a constructive stance to reform the global economic governance system and promote an open world economy.

- BRAZIL SOY EXPORTS SEEN REACHING 688,120 TNS IN NOVEMBER – ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 4.15 MLN TNS IN NOVEMBER – ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.2 MLN TNS IN NOVEMBER – ANEC

Argentina corn production down on continued dryness despite decent planting pace – Refinitiv Commodities Research

2020/21 ARGENTINA CORN PRODUCTION: 44.5 [39.4–48.8] MILLION TONS, DOWN 2% FROM LAST UPDATE

2021/22 Russia wheat production stable as dryness continues and sowings near completion – Refinitiv Commodities Research

2021/22 RUSSIA WHEAT PRODUCTION: 78.4 [68.5–91.0] MILLION TONS, unchanged last update

Most of Ukraine’s winter grain crops sown for the 2021 harvest are in good and satisfactory condition, analyst APK-Inform said, citing weather forecasters; the economy ministry said on Tuesday farmers had sown 5.65 million hectares of winter wheat, or 92% of the expected area as of Nov. 2.

Ukraine corn production sees further reductions as harvests continue – Refinitiv Commodities Research

2020/21 UKRAINE CORN PRODUCTION: 32.3 [27.8–41.7] MILLION TONS, down <1% from last Update

Ukraine rapeseed production unchanged as sowings pick up pace – Refinitiv Commodities Research

2021/22 UKRAINE RAPESEED PRODUCTION: 3.4 [3.1–4.1] MILLION TONS, unchanged from last update

Kazakhstan wheat production unchanged as harvests complete – Refinitiv Commodities Research

2020/21 KAZAKHSTAN WHEAT PRODUCTION: 12.3 [9.8–13.2] MILLION TONS, unchanged from last update

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.