TODAY—WEEKLY ETHANOL STATS

Overnight trade has SRW Wheat unchanged, HRW up 2; HRS Wheat up 2, Corn is up 2 cents; Soybeans unchanged; Soymeal unchanged, and Soyoil up 10 points.

Chinese Ag futures are closed for a week long holiday (Oct 1st thru 8th).

Malaysian palm oil prices were up 34 ringgit at 2,852 (basis December) at midsession as wet weather concerns and tighter virus curbs raises output fears.

U.S. Weather Forecast: The 6 to 10 day forecast for the Midwest after staying mainly dry for the rest of the week has a front bringing light to moderate rains to MN and NW IA early next week. Remnants of Delta will be bringing moderate rainfall for the OH River Valley. The models differ going from midweek forward. The GFS has light to moderate rains for MN and WI with lesser amounts to mostly dry the further south you go in the region. The European model has moderate rainfall for all of the Midwest. Temps will move to above average by the weekend and stay a bit above average through most of next week. The Southern Plains over the 6 to 10 day period has the models differing with the GFS mainly dry for the region while the European model has light to moderate rainfall for areas except the western third of TX and OK. Temps will be running above average.

South America Weather Forecast: The Brazilian growing regions still has little rainfall for most areas except for central/east (light amounts for northern Rio Grande do Sul, Santa Catarina, and southern Parana) through Friday. Rainfall looks to develop in the north over the weekend favoring the state of Mato Grosso with light to moderate amounts. The 6 to 10 day forecast does have rainfall developing north of Parana with light to moderate amounts and 85% coverage. The Argentine growing regions has mostly dry weather over the next 10 days with some light rainfall in Buenos Aries later in the weekend.

Europe/Black Sea Region Forecast: No serious changes were noted this evening, although there was some reduction in Italy rainfall October 17-19; the GFS model runs offered a few more showers in eastern Ukraine and the middle Volga River Basin relative to the mid-day model run; the change was minor, but any rainfall in these areas would be welcome.

The player sheet had funds net buyers of 7,000 contracts of SRW Wheat; net bought 25,000 Corn; net bought 20,000 Soybeans; bought 10,000 Soymeal, and; net bought 4,000 Soyoil.

We estimate Managed Money net long 52,000 contracts of SRW Wheat; long 190,000 Corn; net long 277,000 Soybeans; net long 97,000 lots of Soymeal, and; long 98,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 9,000 contracts; HRW Wheat up 4,200; Corn up 9,900; Soybeans up 7,900 contracts; Soymeal up 7,100 lots, and; Soyoil up 255.

Deliveries were ZERO Soymeal and ZERO Soyoil.

There were no changes in registrations—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 361; Soybeans 1; Soyoil 1,907 lots; Soymeal 250; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Japan seeks 118,428t optional-origin wheat—Tunisia bought 92,000t optional-origin wheat—S. Korea bought 206,000,000t S. American corn, bought 59,000t S. American soymeal—Egypt bought 60,000t optional-origin soyoil, 26,000t sunoil—

Barchart, a leading provider of data and technology services to the financial, media, and commodity industries, announces their October cmdty Production Forecasts at 15,119M bu for corn and 4,190M bu for soybeans in the U.S, which incorporates forecasts for end of season yield at 178.2 bu/ac for corn and 50.5 bu/ac for soybeans in the U.S; this represents a decrease in expected yield for corn, relative to the September 2 report, which predicted end of season yield at 178.4 bu/ac; end of season yield for soybeans remains the same at 50.5 bu/ac.

U.S. ethanol exports in August scaled 35% higher to 100.7 million gallons (mg), the largest volume since March; shipments across the border to Canada accelerated 20% to a three-year high of 36.0 mg, equivalent to 36% of total U.S. ethanol exports, while sales to India declined by 20% to 10.5 mg.

U.S. exports of dried distillers grains (DDGS)-the animal feed co-product generated by dry-mill ethanol plants-relaxed 6% in August to 1.02 million metric tons (mt); while southbound shipments tracked 14% lower (138,817 mt), Mexico remained our chief DDGS market for the second consecutive month.

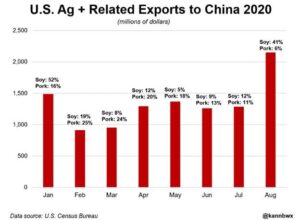

Wire story reports U.S. agricultural exports to China had a sluggish start to 2020 relative to the lofty expectations set forth by the Phase 1 trade agreement, but the August value soared substantially over that of the prior months owing to strong soybean shipments; U.S. cotton exports to China hit a seven-and-a-half-year high in August, while corn shipments to the Asian country reached an all-time record; but the combined export value of cotton and corn, the No. 2 and 3 items in August, was less than half that of soybeans, emphasizing the importance of the oilseed in the trade relationship.

Manitoba crop report – Reuters News: Harvest completion sits at 88%, well ahead the three-year average of 76% at this time; fall fieldwork continues on harvested fields, surface ditching is common; tillage progress has been steady, though dry topsoils across the province are leaving some fields very cloddy and rough; rapid progress in soybean harvest occurred last week, with many producers finishing and starting corn, if they have.

Argentina’s new export tax regime that leaves a higher levy on soybeans than processed soyoil and soymeal has some farmers complaining that they are subsidizing the country’s vast oilseed crushing industry and say it won’t spur growers to sell more; the government last week cut export tax rates on soy and its by-products until the end of the year in a move to encourage more exports and raise much-needed dollars; with prices rising, farmers had been holding onto soy crops waiting for a better time to sell.

Russia could boost poultry meat exports 45% to more than 300,000 tons this year, according to Russian Agricultural (RusAg) Bank’s Center for Industry Expertise; the experts said that attainment of this indicator would mainly depend on maintenance of a positive tendency for supplies to the four most important markets – China, Kazakhstan, Ukraine, and Saudi Arabia; Kazakhstan and Ukraine are traditional markets for Russian poultry farmers; supplies to Saudi Arabia began in 2018; exports to China have been developing since last year.

Rains across much of Ukraine have improved conditions for the winter grain sowing, reducing concerns about the 2021 grain harvest after a severe drought, APK-Inform consultancy said; sufficiently heavy rains in the last days of September and early October ended the long-term air-soil drought in most regions of Ukraine and improved conditions for sowing and the development of winter crops; weather forecasters said this month the weather conditions in Ukraine were the worst in 10 years and only 10% to 15% of arable land was suitable for sowing winter crops for the 2021 harvest because of the severe drought; Ukraine’s economy ministry issued its first official information on winter sowing in late September, saying that only 1.5 million hectares, or 25%, of the expected winter wheat area, had been sown as of Sept. 28.

In Kazakhstan 99.5% of the sown area was harvested with over 20 million tons of grain threshed and the harvest will near 18.5 million tons in clean weight, according to our estimates with the export potential of 7-8 million tons while oilseeds are being still harvested, the Agriculture Minister said; 20.1 million tons of grain have been threshed with the average yield of 1.28 tons per hectare.

Euronext wheat futures rallied on Tuesday to hit the 200 euro mark as dry weather in several exporting countries fueled a broad rally in grain markets; December milling wheat settled 2.25 euros, or 1.1%, up at 200 euros ($235.54) a ton; it earlier climbed to 201 euros, a new life-of-contract high and the highest spot price in nearly five months; dry sowing conditions in Russia and the U.S. Plains again supported a sharp rise in Russian and U.S. wheat futures.

Indonesia palm oil production remains firm amid the high crop season – Refinitiv Commodities Research: The high crop season raises 2019/20 (Oct-Sep) Indonesia palm oil production to 45.1 [43.3-59.7] million tons, up <1% from last update; our palm oil production estimates for new marketing year (2020/21) will start next month.

Malaysia palm oil production up on seasonality, but flooding concerns to affect output next season – Refinitiv Commodities Research: Upward trending crop outputs fractionally raise our estimates for 2019/20 (Oct-Sep) Malaysia palm oil production to 19.3 [17.8–24.1] million tons, up <1% from last update; our estimates for new marketing year (2020/21) will start next month.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.