TODAY—CATTLE ON FEED—COMMITMENT OF TRADERS

Overnight trade has SRW Wheat down roughly 1 cent, HRW up 1; HRS Wheat up 1, Corn is up 2 cents; Soybeans up 1; Soymeal down $1.50, and Soyoil up 20 points.

For the week, SRW Wheat prices are down roughly 27 cents; HRW down 20; HRS down 15; Corn is down 13 cents; Soybeans down 42; Soymeal down $7.00, and; Soyoil down 255 points. Crushing margins are up 8 cents at $0.94; Oil share is down 2% at 32%.

Chinese Ag futures (January) settled up 1 yuan in soybeans, down 15 in Corn, down 6 in Soymeal, down 174 in Soyoil, and down 172 in Palm Oil.

Malaysian palm oil prices were up 29 ringgit at 2,786 (basis December) at midsession with flooding in Indonesia prompting supply concerns, Malaysia Sep 1-25 exports estimated up 7% to 8% on the month.

The player sheet had funds net buyers of 1,000 contracts of SRW Wheat; net sold 17,000 Corn; sold 13,000 Soybeans; sold 7,000 Soymeal, and; net sold 3,000 Soyoil.

We estimate Managed Money net long 21,000 contracts of SRW Wheat; long 48,000 Corn; net long 206,000 Soybeans; net long 60,000 lots of Soymeal, and; long 83,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 2,300 contracts; HRW Wheat down 1,700; Corn down 880; Soybeans down 5,300 contracts; Soymeal down 8,500 lots, and; Soyoil down 5,300.

There were changes in registrations (Corn down 11)—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 211; Soybeans 1; Soyoil 1,907 lots; Soymeal 300; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—S. Korea seeks 68,000t S. American corn—

For the week ended September 17th, U.S. All Wheat sales are running 7% ahead of a year ago, shipments up 4% with the USDA forecasting a 1% increase on the year

For the week ended September 17th, U.S. Corn sales are running 147% ahead of a year ago, shipments 74% ahead with the USDA forecasting a 32% increase

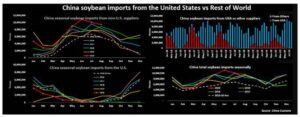

For the week ended September 17th, U.S. Soybean sales are running 193% ahead of a year ago, shipments up 77% with the USDA forecasting a 27% increase on the year

President Donald Trump, looking to shore up support in the U.S. Farm Belt during a tight race for re-election, is taking steps to help producers of corn-based ethanol using a list of policy goals that a group of Midwest senators discussed with him a year ago; on Sept. 12, 2019, Trump met with the senators, who were frustrated by the administration’s management of U.S. biofuels policy; they argued that Trump’s Environmental Protection Agency had been helping the oil industry at the expense of farmers dependent on ethanol sales, and presented him with a list of ways he could fix the problem.

The International Grains Council (IGC) on Thursday trimmed its forecast for global corn (maize) production in the 2020/21 season, partly reflecting a reduced outlook for the U.S. crop.

—In its monthly update, the inter-governmental body reduced its global corn crop forecast by 6 million tons to a still record high of 1.16 billion tons; U.S. corn production was seen at 376.5 million tons, down from a previous projection of 384.2 million.

—The IGC maintained its forecast for 2020/21 world wheat production at a record 763 million tonnes with consumption seen at 749 million.

—Grains stocks were seen rising to a three-year high of 629 million tons by the end of the 2020/21 season, up from 622 million a year earlier, with a cut in corn inventories for the fourth consecutive season more than offset by expansions for wheat, barley and other grains.

—Global soybean production in 2020/21 was kept at 373 million tons with consumption seen at 369 million.

China’s August imports of soybeans from Brazil rose 22% from a year ago, customs data showed on Friday, as buyers increased their purchases to take advantage of higher margins earlier this year.

China’s hog prices continue to fall and the decline is accelerating, says senior Asia commodity analyst; I think it’s likely we see a flush out and some panic selling from farmers ahead of the holiday; National average hog prices are now CNY33.67/kg, down 8.5% since the start of the month; He adds that China’s pork prices are falling as well and StoneX’s consumer price update this week has major cuts of pork falling to levels not seen since June.

Brazilian exports of soybeans will rise 1.2% to 82M metric tons in 2021 from this year after the country’s farmers grow a record crop, an analyst at Datagro; revenue from the sales abroad will rise 13% to $31.6B; Datagro has forecast a crop of 131.7M tons for the 2020-2021 growing season, which would beat the record set in 2019-2020

Drought-hit Argentine wheat fields might get some relief over the weekend if rain forecasts prove correct, the Buenos Aires Grains Exchange said in its weekly crop report on Thursday; some 60% of planted area was in average to very dry condition, the report said, up from 50% a week earlier.

French farmers had harvested 15% of this year’s grain maize crop by Sept. 21, compared with 4% a week earlier, farm office FranceAgriMer said

Another three cases of African swine fever (ASF) have been confirmed in wild boars in the eastern German state of Brandenburg, Germany’s federal agriculture ministry said; the new discoveries bring the total confirmed cases to 32 since the first one on Sept. 10, all in wild animals, with no farm pigs affected.

Japan’s feed production is projected to increase slightly in 2020-21, reflecting stable livestock production and a slight increase in poultry production, the U.S. Department of Agriculture says; it adds; sorghum consumption in 2020-21 is forecast to continue its downward trend as inexpensive corn and rice take its place in Japan’s overall compound feed mix; sluggish food service demand and strong domestic production are forecast to lower Japan’s overall wheat imports to 5.45 million tons in 2020-21, USDA says.

Malaysia’s palm oil exports during the Sept. 1-25 period are estimated to have risen 14.1% from a month earlier to 1,320,949 metric tons, cargo surveyor SGS (Malaysia) Bhd. said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.