TODAY—EXPORT INSPECTIONS—LAST TRADING DAY FOR DEC FUTURES—

Overnight trade has SRW Wheat down roughly 7 cents, HRW down 7; HRS Wheat down 4, Corn is up 2 cents; Soybeans up 9; Soymeal up $1.50, and Soyoil up 65 points.

For the week, SRW Wheat prices were up roughly 36 cents; HRW up 35; HRS up 20; Corn was up 3; Soybeans up 1 cent;

Soymeal down $2.00, and; Soyoil down 10 points. Crushing margins were $0.91 (MCH); Oil share 33%.

Chinese Ag futures (May) settled down 135 yuan in soybeans, down 14 in Corn, down 15 in Soymeal, up 80 in Soyoil, and up 34 in Palm Oil.

Malaysian palm oil prices were up 42 ringgit at 3,452 (basis February) on reports of supply distributions in Malaysia and Indonesia.

South America Weather Forecast: Brazil weather is favorable since rain will fall at one time or another in all of the nation over the next two weeks. Argentina crops would be favorable if rain falls later this week as advertised, but it would not be surprising to see some of the precipitation lighter than advertised. Sufficient rain will fall in northern Argentina to maintain a very good environment for crop development after some welcome rain fell during this past weekend. The absence of excessive heat will help crops cope with the drier days, but temperatures will still be warm enough to keep evaporation rates high.

The player sheet had funds net buyers of 18,000 contracts of SRW Wheat; bought 7,000 Corn; net bought 6,000 Soybeans; net bought 4,000 lots of Soymeal, and; bought 1,000 lots of Soyoil.

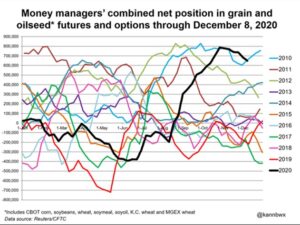

We estimate Managed Money net long 37,000 contracts of SRW Wheat; long 284,000 Corn; net long 195,000 Soybeans; net long 66,000 lots of Soymeal, and; long 95,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 4,000 contracts; HRW Wheat up 4,900; Corn up 4,400; Soybeans up 6,700 contracts; Soymeal up 4,500 lots, and; Soyoil up 6,600.

Deliveries were ZERO Soymeal; ZERO Soyoil; ZERO Corn; 1 HRW Wheat; ZERO Oats; 3 SRW Wheat, and; 4 HRS Wheat. ;

There were changes in registrations (SRW Wheat down 7; Oats down 36; Soyoil down 4)—Registrations total 84 contracts for SRW Wheat; ZERO Oats; Corn 1; Soybeans 175; Soyoil 1,421 lots; Soymeal 193; Rice 313; HRW Wheat 113, and; HRS 1,078.

Tender Activity—Jordan seeks 120,000t optional-origin wheat—

Speculators’ optimistic views of Chicago-traded corn and soybeans remain at historically high levels despite continued light selling last week, and although the wheat bulls had recently gone dormant, they have likely burst back onto the scene over Russian supply concerns.

The U.S. soybean crush in November was likely down from an all-time high in October, although the daily processing pace remained near the highest on record, according to analysts polled ahead of a National Oilseed Processors Association (NOPA) report due on Tuesday.

NOPA members were estimated to have crushed 180.025 million bushels of soybeans last month; it would be down 2.8% October’s record-large crush of 185.245 million bushels but up 9.2% from November 2019, when NOPA members crushed 164.909 million bushels.

The monthly NOPA report is scheduled for release at 11 a.m. CST (1700 GMT) on Tuesday. The organization releases crush data on the 15th of each month, or the next business day.

Soyoil supplies among NOPA members at the end of November were seen rising to 1.548 billion pounds, up from 1.487 billion pounds at the end of October and 1.448 billion pounds at the end of November 2019; if realized, the stocks would be the largest in four months.

China’s major food-producing province of Henan saw its grain output rose 1.9 percent year on year to reach 68.26 million tonnes this year, according to the Henan Survey Organization with the National Bureau of Statistics. Major grain products, including wheat, corn and rice, have all achieved an increase in yield. Henan has sustained bumper harvest for four consecutive years, with the annual grain output surpassing 65 million tonnes in each of the four year. This year’s record output has been achieved with an increase in the province’s grain cultivation area by 4,253 hectares from the previous year and higher per-unit yield, generating an average output of 6,356 kg per hectare, up 118.5 kg from that in 2019.

Brazil’s tariff-free ethanol import quota with the United States will end on Monday as talks between the two countries on opening up their ethanol and sugar markets have broken down. This means tariffs on U.S. ethanol imports will go back to 20%, the rate imposed by Mercosur on imports from outside the bloc

China has temporarily suspended meat imports from two Brazilian companies; newspaper O Estado de S. Paulo said China halted imports from privately-owned Naturafrig Alimentos Ltda and Plena Alimentos after detecting traces of the novel coronavirus in food packaging.

Argentine grains inspectors and oilseed workers said on Saturday they would extend their wage strike, even as the CIARA-CEC chamber of export companies urged unions to return to the negotiating table.

Russia plans to impose a wheat export tax of 25 euros ($30.4) a tonne between Feb. 15 and June 30, economy minister Maxim Reshetnikov told a government meeting on Monday. The wheat export tax will be in addition to a grain export quota of 17.5 million tonnes to be imposed in the same period to stabilize domestic food prices,

Russia’s December exports of wheat, barley and maize (corn) are estimated at 3.9 million tonnes, down from 4.7 million tonnes in November, the SovEcon agriculture consultancy said.

Ukrainian wheat export prices remained unchanged over the past week due to a slight decrease in demand from key importers, analyst APK-Inform said; Ukrainian 12.5% protein wheat traded at $252-$256 per tonne FOB Black Sea at the end of past week. For the lower-quality 11.5% protein wheat, prices were between $251 and $255 a tonne. Ukraine plans to export 17.5 million tonnes in the 2020/21 July-June season. Corn export prices decreased by $4 a tonne to $226-$230 FOB, APK-Inform said.

Euronext wheat hit a two-week high after a Reuters report that Russia is considering an export tax raised expectations of reduced supply from the world’s biggest wheat exporter. March milling wheat settled up 5.75 euros, or 2.8%, at 210.50 euros ($254.92) a tonne, after reaching its highest since Nov. 27 at 211.25 euros in late trading on Friday. Over the week, the contract added 4.2%, having rebounded sharply from Monday’s two-month low of 199.00 euros.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.