TODAY—NOV OPTIONS EXPIRE—CATTLE ON FEED—COMMITMENT OF TRADERS

Overnight trade has SRW Wheat up roughly 6 cents, HRW up 7; HRS Wheat up 5, Corn is up 2 cents; Soybeans up 1; Soymeal up $3.00, and Soyoil up 5 points.

For the week, SRW Wheat prices are down roughly 1 cent; HRW up 2; HRS up 17; Corn is up 13 cents; Soybeans up 17;

Soymeal up $13.00, and; Soyoil up 45 points. Crushing margins are up 17 cents at $1.26; Oil share is down 1% at 30%.

Chinese Ag futures (January) settled up 15 yuan in soybeans, down 2 in Corn, down 22 in Soymeal, up 118 in Soyoil, and up 110 in Palm Oil.

Malaysian palm oil prices were flat at 2,943 (basis January) mostly on position-evening

U.S. Weather Forecast: Last evening’s GFS model run continued to suggest some meaningful precipitation in West Texas and the southwestern Hard Red Winter Wheat Region Sunday through Tuesday.

South America Weather Forecast: South America is still expected to have improvement of weather over the next two weeks.

The player sheet had funds net sellers of 5,000 SRW Wheat; bought 8,000 Corn; bought 2,000 Soybeans; bought 2,000 Soymeal, and; net bought 4,000 Soyoil.

We estimate Managed Money net long 61,000 contracts of SRW Wheat; long 253,000 Corn; net long 256,000 Soybeans; net long 99,000 lots of Soymeal, and; long 84,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 2,400 contracts; HRW Wheat up 2,200; Corn up 14,700; Soybeans up 1,200 contracts; Soymeal up 8,100 lots, and; Soyoil up 3,100.

There were no changes in registrations—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 361; Soybeans 1; Soyoil 1,907 lots; Soymeal 250; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Jordan seeks 120,000t optional-origin wheat—Tunisia bought 50,000t optional-origin wheat—Turkey bought 150,000t optional-origin wheat—Algeria bought 700,000t optional-origin wheat—Taiwan bought 88,000t U.S. wheat—S. Korea feed group bought 65,000t optional-origin feed wheat, seeks 120,000t S. American soymeal—

For the week ended October 15th, U.S. All Wheat sales are running 10% ahead of a year ago, shipments up 3% with the USDA forecasting a 1% increase on the year

For the week ended October 15th, U.S. Corn sales are running 161% ahead of a year ago, shipments 72% ahead with the USDA forecasting a 31% increase

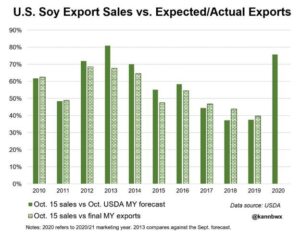

For the week ended October 15th, U.S. Soybean sales are running 148% ahead of a year ago, shipments up 85% with the USDA forecasting a 31% increase on the year

Wire story reports the U.S. Department of Agriculture has projected a banner performance over the next year for domestic corn and soybean exports, and so far, sales have been living up to the hype.

Those bookings have translated to a record shipment pace for soybeans, but corn has yet to turn out the drastically larger export volumes.

U.S. September cattle marketings seen up 5.8% from last year – Reuters News

China imports almost 7 mln T of corn in first 9 months – customs – Reuters News

China’s government is expected to issue more import quotas and buy millions of tons of additional corn in the new crop marketing year, three industry sources said, amid a surge in animal feed demand and tightening supplies; under already approved quotas, Beijing has booked around 12 million tonnes of corn from the United States and around 5 million tonnes from elsewhere including Ukraine for the 2020/21 marketing year, according to a Singapore-based international trading source and two other people with knowledge of the deals.

French farmers had sown 45% of the expected soft wheat area for next year’s harvest as of Oct. 19, up from 12% a week earlier, farm office FranceAgriMer said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.