Soybeans, corn and wheat traded lower. Soyoil managed small gains. Soymeal futures were unchanged. US stocks were lower. US Dollar continued lower. Crude was higher. Be safe.

SOYBEANS

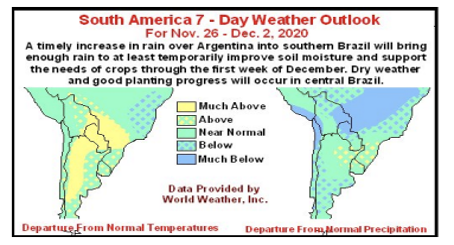

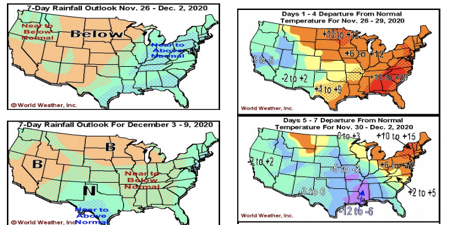

Managed funds were sellers of 8,000 soybeans, 2,000 soymeal and buyers of 2,000 soyoil. We estimate Managed Money net long 222,000 soybeans; net long 78,000 lots of Soymeal, and; long 111,000 Soyoil. There were rumors this am that China bought US soybeans and Brazil new crop soybeans After yesterday losses, Malaysian palmoil futures traded higher. Slowdown in exports and talk China had switched palmoil sales to soyoil weighed on palmoil prices yesterday. Rains are falling across parts of Argentina. South Brazil could see rains early next week. Lack of Brazil monsoon moisture could stress central/north Brazil crops. La Nina could also reduce 2021 rains for south Brazil and east Argentina. This could still lower crops there and increase demand for US corn soybean exports. This could lower US carryouts and push prices above recent highs. For the 4th time SF has pulled back off the 12.00 level. Fridays weekly US export sales could determine if China has been a buyer or seller of US soybeans.

CORN

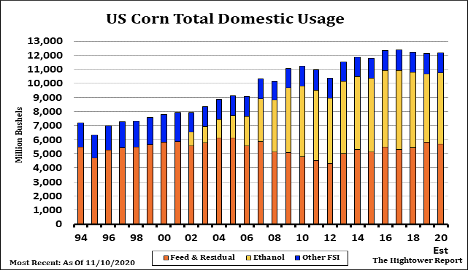

Corn futures traded lower. Continued liquidation of December open interest before the holiday, first notice and month end offered resistance. Lower US equity trade may have also offered resistance. Managed funds were sellers of 5,000 corn. We estimate Managed Money net long 286,000 corn. Yesterday, December contracts open interest dropped 44,000 corn. Today corn were lower on talk that basis levels are lower. There is talk of slowdown in demand and that buyers are unwilling to pay up at recent levels to add to 2021 coverage. Increase cases of Covid also adds to demand uncertainty. Rains are falling across parts of Argentina. South Brazil could see rains early next week. Lack of Brazil monsoon moisture could stress central/north Brazil crops. There are some beginning to lower Brazil 2021 corn crop due to late planting and dry soils. La Nina could also reduce 2021 rains for south Brazil and east Argentina. This could lower US carryouts and push prices above recent highs. One large US Bank estimated China 2021 corn imports near 33 mmt versus USDA guess of 13. Same group estimated China 2022/23 corn imports near 55 mmt. If true USDA needs to make a lot of changes to their US and World corn balance sheet. Fridays weekly US export sales export report could determine if demand is slowing. EIA weekly ethanol production increased and was the highest level since March 20th. US ethanol stocks increased and was the highest level since late June.

WHEAT

Yesterday wheat futures made new highs for 4 weeks. Matif futures made new contract highs. Some link the rally to liquidation of long corn and soybean and short wheat spread positions before the holiday and month end. Talk of a 2021 vaccine also raised US stocks market over 30,000. US Dollar is making new 30 month lows. Today Wheat futures had an outside day lower and traded back below Tuesdays lows. Wheat at times is a follower to the latest headlines that is moving money around. Increase virus cases, Washington politics, vaccine, World weather and global demand continues to make trade choppy and volatile at best. Last week US flour users added to Q1 demand and are 50 pct covered. They also started Q2 coverage by adding 20-25 pct. Weekly US export sales are delayed until Friday. Trade looks for wheat sales near 200-450 mt versus 102 last week. US HRW wheat export price are becoming competitive to French and Russia. Drop in US HRW crop ratings could also be supportive to wheat prices. World June-July to date exports are near last year at this time witch goes against talk of lower demand due to Covid.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.